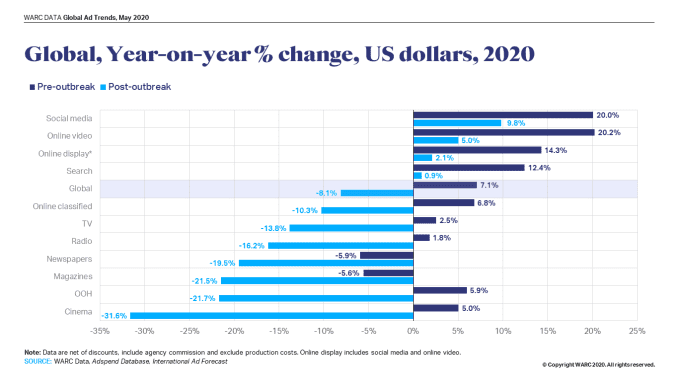

Ad market figures will decrease by 8.1%, which equates to USD 49.6 billion, compared to a previously forecast growth of 7.1%, which indicates that overall global ad spending might reach USD 563 billion in 2020, a decline from the previously estimated USD 612.6 billion.

Global ad spend is projected to decline by USD 50 billion this year as businesses in all sectors continue to suspend delay media buys. Ad market figures will decrease by 8.1%, which equates to USD 49.6 billion, compared to a previously forecast growth of 7.1%, according to data from the World Advertising Research Center (WARC). This indicates that overall global ad spending might reach USD 563 billion in 2020, which is a decline from the previously estimated USD 612.6 billion.

Traditional media outlets have been negatively impacted the most, with TV spend reducing by 13.8% and newspaper ad buys going down 19.5%. Cinema ad spend is set to decline steeply, at 31.6%. Online media will also be affected. Forecasts were reduced despite ad spend growth in previous years. Social media advertising was set to grow by 20% this year, but WARC reduced its prediction to 9.8%, while search advertising is only set to grow by 0.9%, instead of 12.4%. Ad-supported online giants, including Facebook and Google’s parent company Alphabet, reported results in late April and predicts negative results in the second quarter. WARC predicts that Facebook’s ad revenue will reduce by USD 5.3 billion to USD 77.6 billion across all of its platforms this year, including Messenger and Instagram. Alphabet is forecasted to make USD 137.1 billion in ad revenue, a reduction of USD 12.9 billion on pre-pandemic projections.

Latin America will most likely see the steepest decline in ad spend this year, with a forecast of a 20.7% decline, with Africa and the Middle East following. North America is forecast to see the least impact, at 3.7% down, with Europe expected to see a 12.2% fall. Brian Wieser, Global President of Business Intelligence at ad group WPP, said there are ways businesses can reinvent themselves despite the crisis. “Every brand should be questioning assumptions about their company’s competitive position. What are the ways in which you can reinvent the category? That the economy will be weak is a given, but anyone business’s outcomes are not,” he said in a release issued by WARC.

Transport and tourism media budgets are predicted to drop the fastest, followed by leisure and financial services. Ad spend is set to fall by 7.7%. Pharma and healthcare are forecast to see the smallest reduction in ad spend, at 2.1%. Despite the heavy projected fall in ad spend, the declines are set to be less steep than those seen during the 2008 recession, during which the market reduced by 12.7%, which is equivalent to USD 60.5 billion. This is due in part to U.S. presidential election ad spend boosting the market, with political spending set to go up by 26% over 2016 figures, or almost USD 5 billion.

Every brand should be questioning assumptions about their company’s competitive position. What are the ways in which you can reinvent the category? That the economy will be weak is a given, but anyone business’s outcomes are not.” Brian Wieser Global President of Business Intelligence