A recent Horowitz Research survey revealed a spike in demand for high-quality Spanish-language content on behalf of U.S. Hispanic viewers. The figures, parred with demands for English content in the region, reflect a broad range of contemporary U.S. Latinx household demographics. “Latinx consumers have long been underserved in the streaming space, but this is completely changing now," Horowitz’s Adriana Waterston, Senior Vice President, Insights and Strategy, noted.

The report indicates that 80% of U.S. Hispanic TV content viewers subscribed to a streaming service, including 64% of Latinx Spanish-language content viewers. Hispanic streamers pay for an average of four streaming services. “There is a market for all sorts of streamed Spanish and Latinx-themed content, ranging from traditional telenovelas to content that speaks to the sensibilities of younger, bilingual, bicultural U.S. Latinx. Importantly, much of this content will not only appeal to Latinx consumers but other audiences as well,” Waterston said.

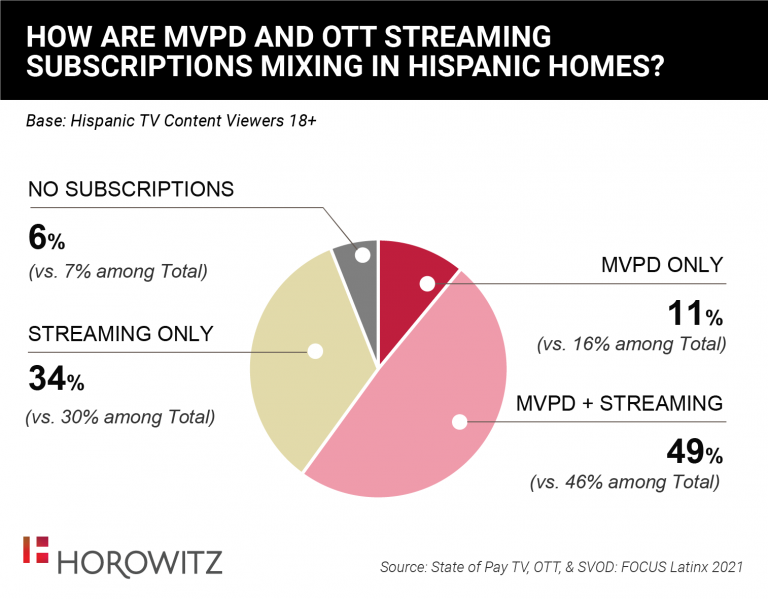

Ranging from Hispanics to Afro-Latino/a/x, just under 50% of consumers, a majority serving as a younger, multilingual, or bicultural family, subscribe to both traditional MVPD platforms and streaming services to fulfill their viewing needs. In contrast, approximately 6 out of 10 Latinx consumers watch Spanish-language content occasionally, and 29% admit to watching content in Spanish but spending the majority of their time watching English content.

The content type has seen a large transition from its accessibility being on traditional broadcast and cable outlets to becoming available on digital streaming platforms, including titles such as Netflix’s “Narcos,” “La Casa de Papel,” “Elite,” and “La Reina del Sur,” among many others. Some of the streamers offering Spanish-language content include Peacock, Amazon Prime Video, FuboTV, Pluto TV, PrendeTV, etc.

Despite enjoying regular television episodes airing daily, as well as the international news coverage available on traditional linear channels, 22% of Latinx TV homes have canceled their cable services within the last three years.“Latinx households have been some of the most loyal customers of MVPD services, driven by the desire to have access to the most robust selection of both English and Spanish content,” Waterston said. “As streaming services amp up their Latinx-oriented offerings, traditional players will need to find new ways to retain their value proposition among this audience.”

Latinx consumers have long been underserved in the streaming space, but this is completely changing now.” Adriana Waterston Senior Vice President, Insights and Strategy, Horowitz