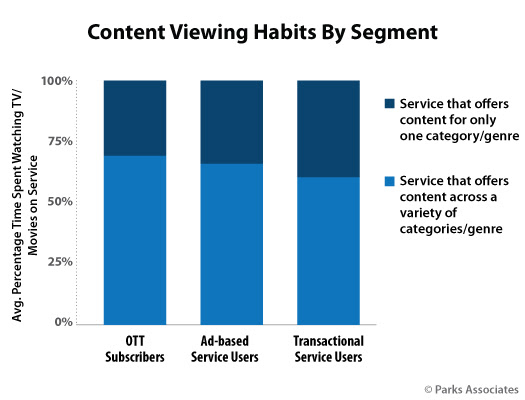

A recent OTT-related research report released by Parks Associates reveals that video viewers who favor one particular genre spend 70% of their viewing time on streaming platforms with a wide variety of content, such as Netflix, Tubi, or AMC+. “Services offering a variety of content categories are the foundation of consumers’ video service ensembles,” said Paul Erickson, Senior Analyst, Parks Associates. “Many niche services have been successful, including those dedicated to horror, religious, children’s, and anime content, and niche services such as ESPN+, Britbox, and Crunchyroll make up an important part of the service ecosystem."

Approximately 44% of audiences spend 76% or more of their OTT viewing time on broad-based services, while 48% spend 25% or less on niche services. The firm’s study, named the Quantified Consumer: Content Preferences in OTT Video, garnered data from more than 5,000 US broadband households to determine the factors that contirbute to driving subscription and viewing time increases, and track current consumer interests.

Ad-based OTT services in particular have broadened their market appeal over the past few years by incorporating different genre categories. Crackle and Pluto TV also made large contributions such as sports channels and children’s programming through a “Tubi Kids” section. “If services are to challenge the ‘Big 3’ OTT services , Netflix, Amazon, Hulu,' they need to feature a variety of programming across genres,” Erickson said. “We will see more bundling services emerge like AMC, which bundled together its niche services Shudder, SundanceNow, and IFC Films under the AMC+ service umbrella in order to give viewers more options.”

The study determine that content continues to be the main factor considered by potential customers, followed by costs, which have led some platforms to adjust their pricing points. Disney+ has introduced transactional purchases, while Peacock is using a freemium model and HBO Max and Paramount+ offer less expensive ad-supported tiers. “A hybrid pricing approach meets consumers where they are,” Erickson said. “Maximizing revenue potential with hybrid pricing will help services finance the growing cost of content library growth.”

Services offering a variety of content categories are the foundation of consumers’ video service ensembles. Many niche services have been successful, including those dedicated to horror, religious, children’s, and anime content, and niche services such as ESPN+, Britbox, and Crunchyroll make up an important part of the service ecosystem.” Paul Erickson Senior Analyst, Parks Associates