Quibi recently informed subscribers in Australia and New Zealand about two large adjustments made to the service: Monthly subscription fees will be reduced by 40%, and an free ad-supported plan would be carried out in gradual stages. The changes indicate long-term, varied implementations for giant markets such as the United States, according to research consultancy TDG, a division of Screen Engine-ASI. “It was inevitable that Quibi would make such moves,” Senior Analyst and Author of TDG’s new analysis, Lauren Kozak said. “The question is how much longer the company can wait before implementing similar changes in the U.S., especially as the pandemic extends into the fall and winter.”

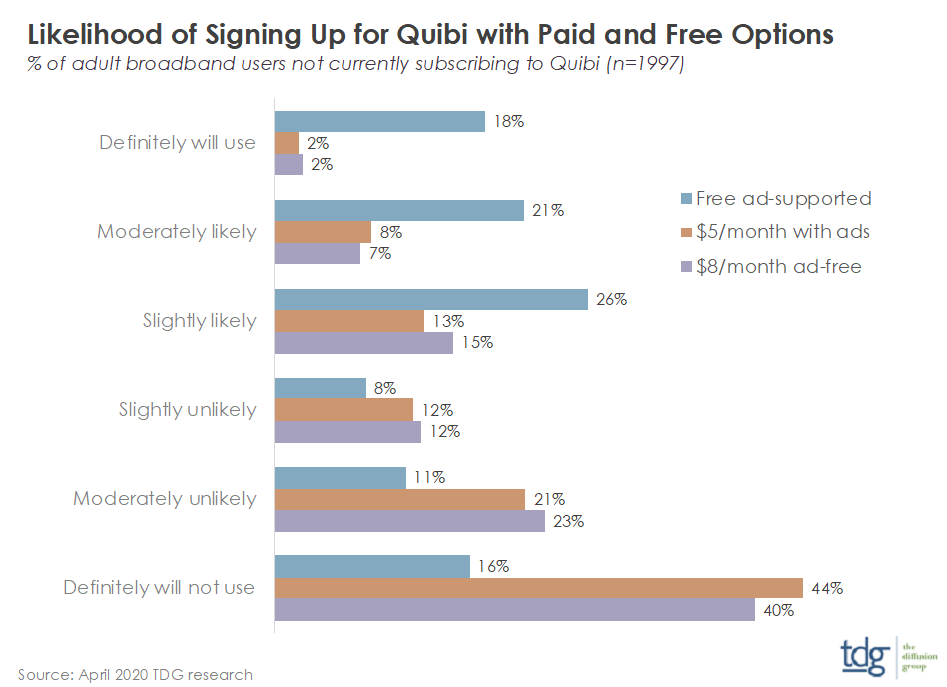

Kozak has analyzed various factors driving demand, or lack thereof for the new streamer. Among them, the lack of interest in it. According to April 2020 TDG research, 10% of U.S. adults were at least likely to consider signing up for Quibi at its current price. In a survey conducted back in April, TDG asked adult broadband users how likely they would be to sign up for Quibi at USD8/month ad-free and USD 5/month with ads and to use if free with ads, and though improvement in the cost of services was expected, it didn’t occur in terms of non-zero costs.

The Top-2 scores of USD 8 vs. USD 5/month price points were 9% and 10% with bottom-2 scores of 63% and 65%. At USD 5 or more per month, then, Quibi has little chance of success. However, if the service were free with ads, four-in-ten adult broadband users would watch, with 18% certain to do so. Another 34% are on the bubble, either slightly likely or unlikely to view. “Therein lies Quibi’s best chance to weather the pandemic, or to even build a userbase at all,” says Kozak.

The report partially shifts the blame for the lack of success on the service’s inability to understand its target audience, which appears to be younger millennials and Gen Z’s who have, for the most part, made it a habit to watch short-form videos free of cost. “Social networks dominate short-form video viewing among young adults, capturing hundreds of millions of viewers,” Kozak said. “Yet none, including YouTube and Facebook, have been able to convince young adults to pay a fee each month to watch professional content.”

TDG’s newest report, “In Search of Audience: Quibi’s post-pandemic Prospects,” written by Kozak, examines the business and content model of the service during its launch and discusses Quibi’s potential for sales after the pandemic. The data expert noted that Quibi’s 5-10-minute format quickly alerts viewers about the free content. “At this point in the evolution of mobile short-form video, and regardless of new features and formats, introducing a paywall is problematic,” she said.

was inevitable that Quibi would make such moves. The question is how much longer the company can wait before implementing similar changes in the U.S., especially as the pandemic extends into the fall and winter.” Lauren Kozak Senior Analyst and Author of TDG