Emarketer revealed in a recent report in which it forecasts a 5.9% growth in search ad spending this year. As the pandemic continues to transform retail sales to digital channels, additional search advertising is being conducted by digital merchants.

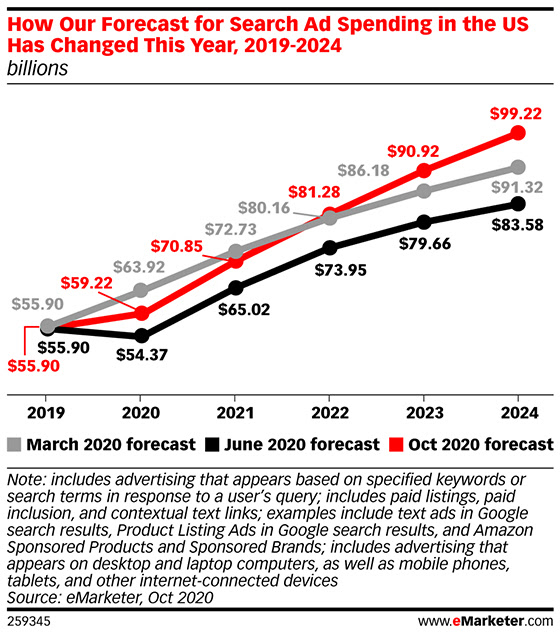

As a result of the economic disruption caused by the pandemic, Emarketer’s 2020-2021 spending forecast led to a lower budget. The researcher initially expected ad spending in the US to grow by 14.4% this year in favor of the growing trends of gradual growth between 2018 and 2024. However, as more information was reported about the pace of consumer e-commerce spending, the odds became better for advertisers. Emarketer’s new forecast exceeds pre-pandemic projections for 2022, with advertisers expected to spend USD 99.22 billion on search in 2024, a USD 91.32 billion increase from the previous forecast.

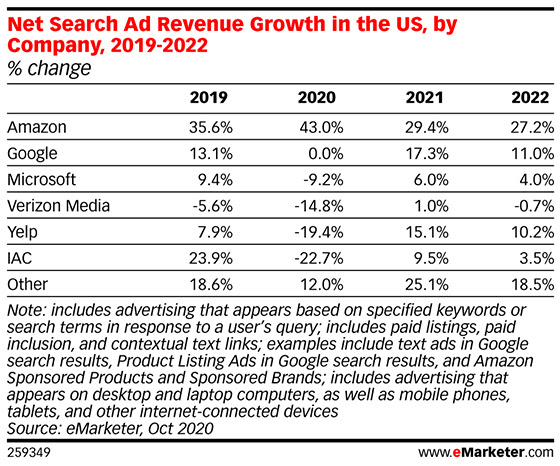

Amazon reported strong growth in its “other” revenues, the category under which the company’s advertising revenues fall in its earnings reports in Q1 and Q2 of this year. The increases were reported despite massive shopping taking place on the main online shop as consumers depend on it for almost any sort of item. Emarketer’s prediction for Amazon was then shifted to a 43% increase this year. Amazon later reported an acceleration of growth in its “other” revenues to 49% in Q3.

Last month, Google reported a 6.5% year-over-year growth in search ad revenues during the third quarter, a reflection of its previously announced trending consumer queries and strong spending on behalf of e-commerce advertisers. The majority of the spending will be attributed to mobile devices, with its share expected to blossom by two-thirds by 2024. Desktop and laptop search ad spending will not rise much this year as a result of a large decline in “the big-ticket.” Categories such as consumer packaged goods are more likely to be searched and purchased on mobile devices.

The conclusions drawn from the findings are that Google search ad has shown higher revenue growth than ever before, and Amazon will ultimately reap the most benefits from the increasing e-commerce trend, driving the conglomerate to increase its spending. In June, Emarketer expected Google’s net share of US search ad spending to drop from 61.3% last year to 57.5% by 2022. Google’s share predictions are now set to drop to 54.9% in 2022. Amazon is likely to net 21.5% of US search ad spending that year, a 19% increase from the researcher’s previous estimates.